U.S. Federal Deficits, Presidents, and Congress

by Stephen Bloch

Last update: Oct. 14, 2014

Numbers for Sept. 30, 2014

To anybody who’s followed this page over the years: In October, 2013, I changed the formula for adjusting for inflation, so the numbers in this page don’t match what was on this page before Oct. 2013. The old version of the page is here.

Some time in early 2004, I ran across a Web site maintained by the Department of the Treasury, listing the U.S. National Debt year by year since 1791. The numbers by themselves are too big to be meaningful, so I put them into a spreadsheet to see if I could extract any interesting trends and patterns.

In particular, I wanted to be able to compare the effects of government policies under different Presidents and Congresses on budget deficits. This sort of comparison will inevitably have political implications, so I resolved to make the page as transparent and fact-based as possible: if you don’t like my conclusions, here are the data and you can replicate them yourself. I was concerned about (conscious or unconscious) political bias, so I wanted to avoid any sort of sophisticated analysis that required lots of judgment calls. But some judgment calls are unavoidable.

Which President or Congress?

One issue is to which President or Congress a particular year’s deficit should be attributed. U.S. Congressional terms start on Jan. 1, Presidential terms later in January, and the fiscal year on Oct. 1, so none of them exactly match up. Since most Presidential and Congressional actions take months to be implemented, much less to show a measurable effect on the debt, I decided that the fiscal year spanning a change of (Presidential and/or Congressional) terms would be counted as belonging to the outgoing President and Congress.

How to define “deficit”?

Another question was how to define the word “deficit”. In trying to keep things simple and transparent, I chose “one year’s national debt minus the previous year’s national debt”. But even that simple definition doesn’t entirely resolve things.

Which national debt?

The Treasury reports three numbers: “Public Debt”, “Intragovernmental Holdings”, and “Total Debt”, which is the sum of the other two. The difficult question is whether to use “Public Debt” or “Total Debt” in the data analysis. The question is made easier by the fact that “Public Debt” and “Intragovernmental Holdings” weren’t reported until 1997, so if I want to cover history farther back than 1997, I have no choice

Intragovernmental debt, as I understand it, is mostly Treasury bonds held by the Social Security and Medicare trust funds, which are part of the Federal government in a sense, but there are legal walls between them and the Treasury. When you pay Social Security tax, your dollars go to the Social Security administration, which promptly transfers them to the Treasury in exchange for bonds, which are held in the Social Security trust fund until they need to be sold or redeemed for dollars to pay Social Security benefits. Thus Social Security and Medicare taxes increase the intragovernmental debt, while simultaneously increasing the Treasury’s store of dollars that it can use to pay for other things (which tends to reduce the public debt by the same amount); they have no effect on the Treasury’s net worth. Social Security and Medicare benefit payments have the opposite effect: still no effect on the Treasury’s net worth. So if I want to ignore the effect of Social Security and Medicare taxes and benefits, the “total debt” is the right figure to use. I think.

How to adjust for inflation?

I wanted to adjust for inflation so one could meaningfully compare deficits from more than a few years apart. Originally, I used the formula

(debt in year X) – (debt in year X-1)

————————————-

(CPI in year X)

Then an economics-professor friend of mine pointed out a problem with this. Suppose the national debt is a trillion dollars, and the inflation rate is 10%. If the government spends exactly as much as it takes in this year, the national debt will still be a trillion dollars, but those dollars will be 10% less valuable a year from now; the nation is less deeply in debt than before, because it’s easier to pay off the debt with inflated dollars.

To look at it another way, part of any year’s government expenditures is interest on the national debt, paid at a rate that must be higher than inflation (or nobody would buy the bonds). So suppose we want to compare two governments: each inherits a $1 trillion national debt, and each spends exactly as much as it takes in, aside from interest payments, but one of them has 0% inflation and the other 10% inflation. All else being equal, the latter will have to pay 10% higher interest rates to bond-holders. So of these two governments, the latter shows up as having a $100 billion larger deficit than the former, even though both are in some sense equally fiscally responsible and this $100 billion increase in nominal debt is cancelled by inflation.

So as of Oct. 2013, I’m calculating deficit as

(debt in year X) (debt in year X-1)

—————- – ——————

(CPI in year X) (CPI in year X-1)

Note that if there was no inflation in year X, this produces the same answer as the previous formula; in the presence of inflation, it produces a smaller number, and when there’s deflation, it produces a larger number.

What I did

Tabulated the national debt by year, back to 1911. (I originally went only back to my birth, in 1964, but then expanded the chart to 1911, stopping there because I ran out of CPI data.)

Adjusted these debts by the Consumer Price Index as of the end of the fiscal year to get a debt in constant (1983) dollars. (There’s nothing magical about 1983, except that CPI figures are often expressed in 1983 dollars. If I used, say, 2006 dollars, all the numbers would be about half as large, but the shape of the curve would be exactly the same.)

Subtracted each year’s constant-dollar debt from the next year’s, as a measure of one-year federal deficit (including interest paid).

In 1977, the reporting date shifted by 3 months, so that “year” was actually 15 months long; I multiplied the deficit in this year by 4/5 to give an annualized figure. I did something similar for 2012-2013 and 2013-2014, which were distorted by the debt ceiling standoff; see below.

Annotated each year by the party of the President and the majority party in each house of Congress (see House history and Senate history). Many years show a transition from one party to another.

Also annotated each year with the top-bracket individual marginal Federal income tax rate for returns filed that year (i.e. on the previous year’s income), drawn from The Tax Foundation. This is an oversimplification, of course, since it doesn’t say where that top tax bracket starts: for example, in 1992 the top tax bracket was 31% on income above $86,500, and in 1993 it was 39.6% on income above $250,000, but somebody who earned $125,000 in each of those two years would have seen almost no change. More dramatically, in 1941 it was 81% on income above $5 million, and in 1942 it was 88% on income above $200,000; somebody earning $250,000 in both years would have seen a marginal tax rate rise not from 81% to 88% but rather from 71% to 88%.

Note that it’s hard to ascribe cause and effect here: for example, when a war starts, tax rates and deficits usually both go up, but it would be hard to claim that one is because of the other; in fact, both are because of the cost of the war.

I haven’t done much analysis of the Congressional data yet: I’d like to see whether party control of the Senate makes a consistent difference, whether party control of the House makes a consistent difference, whether the margin of control (e.g. 51% as opposed to 69%) makes a consistent difference, whether having the House and Senate controlled by the same party makes a consistent difference, whether having one or both houses of Congress controlled by the same party as the President makes a consistent difference, etc. But the data are there: perhaps somebody else will do that analysis for me

Table 1: Deficit by year, corrected for inflation

These are the data from which all of the following tables are drawn, organized by year so you can draw your own conclusions about Presidents, Congresses, tax rates, etc.

The inflation-adjusted debt (seventh) column is simply the public debt expressed in 1983 dollars.

The deficit (eighth) column is the difference between one year’s inflation-adjusted debt and the previous year’s (annualized in years that for various reasons were longer or shorter than 12 months). I display this both as a number and as a bar-graph.

| Fiscal year | President’s

party |

Senate

majority party |

House

majority party |

Top-bracket

marginal income tax rate |

National debt

(millions) |

National debt

(millions of 1983 dollars) |

Deficit

(millions of 1983 dollars) |

Deficit in 1983 dollars ($=10 billion) | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 11/2013-9/2014 | D | D | R | 39.6% | $17,824,071 | $7,493,766 | $161,279

(annualized) |

$$$$$$$$$$$$$$$$ | |||

| 10/2012-10/2013 | D | D | R | 39.6% | $17,156,117 | $7,345,926 | $403,076

(annualized) |

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/2011-9/2012 | D | D | R | 35% | $16,066,241 | $6,942,850 | $424,094 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/2010-9/2011 | D | D | D | R | 35% | $14,790,340 | $6,518,756 | $310,330 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | ||

| 10/2009-9/2010 | D | D | D | 35% | $13,561,623 | $6,208,425 | $693,824 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$ |

|||

| 10/2008-9/2009 | R | D | D | D | 35% | $11,909,829 | $5,514,601 | $932,561 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ |

||

| 10/2007-9/2008 | R | D | D | 35% | $10,024,724 | $4,582,040 | $261,615 | $$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/2006-9/2007 | R | R | D | R | D | 35% | $9,007,653 | $4,320,424 | $127,731 | $$$$$$$$$$$$$ | |

| 10/2005-9/2006 | R | R | R | 35% | $8,506,973 | $4,192,692 | $202,396 | $$$$$$$$$$$$$$$$$$$$ | |||

| 10/2004-9/2005 | R | R | R | 35% | $7,932,709 | $3,990,296 | $104,539 | $$$$$$$$$$ | |||

| 10/2003-9/2004 | R | R | R | 35% | $7,379,052 | $3,885,757 | $223,105 | $$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/2002-9/2003 | R | D | R | R | 38.6% | $6,783,231 | $3,662,652 | $221,637 | $$$$$$$$$$$$$$$$$$$$$$ | ||

| 10/2001-9/2002 | R | D | R | 39.1% | $6,228,235 | $3,441,014 | $183,884 | $$$$$$$$$$$$$$$$$$ | |||

| 10/2000-9/2001 | D | R | R | D | R | 39.6% | $5,807,463 | $3,257,130 | -$9,523 | ||

| 10/1999-9/2000 | D | R | R | 39.6% | $5,674,178 | $3,266,654 | -$102,179 | ||||

| 10/1998-9/1999 | D | R | R | 39.6% | $5,656,270 | $3,368,833 | -$9,035 | ||||

| 10/1997-9/1998 | D | R | R | 39.6% | $5,526,193 | $3,377,869 | $19,838 | $$ | |||

| 10/1996-9/1997 | D | R | R | 39.6% | $5,413,146 | $3,358,031 | $46,997 | $$$$$ | |||

| 10/1995-9/1996 | D | R | R | 39.6% | $5,224,810 | $3,311,034 | $64,308 | $$$$$$ | |||

| 10/1994-9/1995 | D | D | R | D | R | 39.6% | $4,973,982 | $3,246,725 | $105,661 | $$$$$$$$$$$ | |

| 10/1993-9/1994 | D | D | D | 39.6% | $4,692,749 | $3,141,064 | $100,755 | $$$$$$$$$$ | |||

| 10/1992-9/1993 | R | D | D | D | 31% | $4,411,488 | $3,040,309 | $163,720 | $$$$$$$$$$$$$$$$ | ||

| 10/1991-9/1992 | R | D | D | 31% | $4,064,620 | $2,876,589 | $205,085 | $$$$$$$$$$$$$$$$$$$$$ | |||

| 10/1990-9/1991 | R | D | D | 28% | $3,665,303 | $2,671,504 | $234,945 | $$$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/1989-9/1990 | R | D | D | 28% | $3,233,313 | $2,436,559 | $150,614 | $$$$$$$$$$$$$$$ | |||

| 10/1988-9/1989 | R | D | D | 28% | $2,857,430 | $2,285,945 | $113,710 | $$$$$$$$$$$ | |||

| 10/1987-9/1988 | R | D | D | 38.5% | $2,602,337 | $2,172,235 | $128,516 | $$$$$$$$$$$$$ | |||

| 10/1986-9/1987 | R | R | D | D | 50% | $2,350,276 | $2,043,719 | $115,132 | $$$$$$$$$$$$ | ||

| 10/1985-9/1986 | R | R | D | 50% | $2,125,302 | $1,928,587 | $245,204 | $$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 10/1984-9/1985 | R | R | D | 50% | $1,823,103 | $1,683,382 | $185,986 | $$$$$$$$$$$$$$$$$$$ | |||

| 10/1983-9/1984 | R | R | D | 50% | $1,572,266 | $1,497,396 | $129,760 | $$$$$$$$$$$$$ | |||

| 10/1982-9/1983 | R | R | D | 50% | $1,377,210 | $1,367,637 | $201,105 | $$$$$$$$$$$$$$$$$$$$ | |||

| 10/1981-9/1982 | R | R | D | 70% | $1,142,034 | $1,166,531 | $95,871 | $$$$$$$$$$ | |||

| 10/1980-9/1981 | D | R | D | R | D | 70% | $997,855 | $1,070,660 | -$9,937 | ||

| 10/1979-9/1980 | D | D | D | 70% | $907,701 | $1,080,596 | -$27,338 | ||||

| 10/1978-9/1979 | D | D | D | 70% | $826,519 | $1,107,934 | -$52,282 | ||||

| 10/1977-9/1978 | D | D | D | 70% | $771,544 | $1,160,217 | $22,041 | $$ | |||

| 7/1976-9/1977 | R | D | D | D | 70% | $698,840 | $1,138,176 | $36,691

(annualized) |

$$$$ | ||

| 7/1975-6/1976 | R | D | D | 70% | $620,433 | $1,092,312 | $97,556 | $$$$$$$$$$ | |||

| 7/1974-6/1975 | R | D | D | 70% | $533,189 | $994,756 | $25,246 | $$$ | |||

| 7/1973-6/1974 | R | D | D | 70% | $475,059 | $969,510 | -$67,010 | ||||

| 7/1972-6/1973 | R | D | D | 70% | $458,141 | $1,036,519 | $11,914 | $ | |||

| 7/1971-6/1972 | R | D | D | 70% | $427,260 | $1,024,605 | $43,990 | $$$$ | |||

| 7/1970-6/1971 | R | D | D | 70% | $398,129 | $980,615 | $24,639 | $$ | |||

| 7/1969-6/1970 | R | D | D | 70% | $370,918 | $955,976 | -$10,473 | ||||

| 7/1968-6/1969 | D | R | D | D | 70% | $353,720 | $966,449 | -$35,218 | |||

| 7/1967-6/1968 | D | D | D | 70% | $347,578 | $1,001,667 | $22,024 | $$ | |||

| 7/1966-6/1967 | D | D | D | 70% | $326,220 | $979,642 | -$7,725 | ||||

| 7/1965-6/1966 | D | D | D | 70% | $319,907 | $987,368 | -$16,664 | ||||

| 7/1964-6/1965 | D | D | D | 77% | $317,273 | $1,004,031 | -$1,494 | ||||

| 7/1963-6/1964 | D | D | D | 91% | $311,712 | $1,005,525 | $5,984 | $ | |||

| 7/1962-6/1963 | D | D | D | 91% | $305,859 | $999,541 | $12,121 | $ | |||

| 7/1961-6/1962 | D | D | D | 91% | $298,200 | $987,420 | $17,719 | ||||

| 7/1960-6/1961 | R | D | D | D | 91% | $288,970 | $969,701 | $2,367 | |||

| 7/1959-6/1960 | R | D | D | 91% | $286,330 | $967,334 | -$11,037 | ||||

| 7/1958-6/1959 | R | D | D | 91% | $284,705 | $978,371 | $22,166 | $$ | |||

| 7/1957-6/1958 | R | D | D | 91% | $276,343 | $956,205 | -$6,525 | ||||

| 7/1956-6/1957 | R | D | D | 91% | $270,527 | $962,730 | -$40,030 | ||||

| 7/1955-6/1956 | R | D | D | 91% | $272,751 | $1,002,760 | -$24,858 | ||||

| 7/1954-6/1955 | R | R | D | R | D | 91% | $274,374 | $1,027,619 | $19,219 | $$ | |

| 7/1953-6/1954 | R | R | R | 92% | $271,259 | $1,008,400 | $15,598 | $$ | |||

| 7/1952-6/1953 | D | R | D | R | D | R | 92% | $266,071 | $992,802 | $15,047 | $$ |

| 7/1951-6/1952 | D | D | D | 91% | $259,105 | $977,7553 | -$7,658 | ||||

| 7/1950-6/1951 | D | D | D | 91% | $255,221 | $985,413 | -$95,920 | ||||

| 7/1949-6/1950 | D | D | D | 91% | $257,357 | $1,081,333 | $23,717 | $$ | |||

| 7/1948-6/1949 | D | R | D | R | D | 91% | $252,770 | $1,057,617 | $10,761 | $ | |

| 7/1947-6/1948 | D | R | R | 91% | $252,292 | $1,046,856 | -$127,173 | ||||

| 7/1946-6/1947 | D | D | R | D | R | 91% | $258,286 | $1,174,029 | -$266,731 | ||

| 7/1945-6/1946 | D | D | D | 94% | $269,422 | $1,440,760 | $11,577 | $ | |||

| 7/1944-6/1945 | D | D | D | 94% | $258,682 | $1,429,183 | $287,119 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 7/1943-6/1944 | D | D | D | 88% | $201,003 | $1,142,065 | $360,944 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 7/1942-6/1943 | D | D | D | 88% | $136,696 | $781,121 | $336,811 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |||

| 7/1941-6/1942 | D | D | D | 81% | $72,422 | $444,309 | $111,238 | $$$$$$$$$$$ | |||

| 7/1940-6/1941 | D | D | D | 79% | $48,961 | $333,071 | $28,337 | $$$ | |||

| 7/1939-6/1940 | D | D | D | 79% | $42,967 | $304,734 | $11,694 | $ | |||

| 7/1938-6/1939 | D | D | D | 79% | $40,439 | $293,040 | $29,460 | $$$ | |||

| 7/1937-6/1938 | D | D | D | 79% | $37,164 | $263,579 | $10,631 | $ | |||

| 7/1936-6/1937 | D | D | D | 79% | $36,424 | $252,949 | $8,177 | $ | |||

| 7/1935-6/1936 | D | D | D | 63% | $33,779 | $244,772 | $35,276 | $$$$ | |||

| 7/1934-6/1935 | D | D | D | 63% | $28,700 | $209,496 | $7,606 | $ | |||

| 7/1933-6/1934 | D | D | D | 63% | $27,053 | $201,889 | $24,419 | $$ | |||

| 7/1932-6/1933 | R | D | R | D | D | 63% | $22,539 | $177,470 | $34,183 | $$$ | |

| 7/1931-6/1932 | R | R | D | 25% | $19,487 | $143,287 | $32,020 | $$$ | |||

| 7/1930-6/1931 | R | R | R | D | 25% | $16,801 | $111,267 | $14,926 | $ | ||

| 7/1929-6/1930 | R | R | R | 25% | $16,185 | $96,341 | -$2,671 | ||||

| 7/1928-6/1929 | R | R | R | 25% | $16,931 | $99,012 | -$3,937 | ||||

| 7/1927-6/1928 | R | R | R | 25% | $17,604 | $102,949 | -$2,232 | ||||

| 7/1926-6/1927 | R | R | R | 25% | $18,511 | $105,181 | -$5,797 | ||||

| 7/1925-6/1926 | R | R | R | 25% | $19,643 | $110,979 | -$6,257 | ||||

| 7/1924-6/1925 | R | R | R | 46% | $20,516 | $117,235 | -$7,769 | ||||

| 7/1923-6/1924 | R | R | R | 58% | $21,251 | $125,005 | -$6,464 | ||||

| 7/1922-6/1923 | R | R | R | 58% | $22,349 | $131,469 | -$6,036 | ||||

| 7/1921-6/1922 | R | R | R | 73% | $22,963 | $137,505 | $1,270 | ||||

| 7/1920-6/1921 | D | R | R | R | 73% | $23,977 | $136,236 | $12,061 | $ | ||

| 7/1919-6/1920 | D | R | R | 73% | $25,952 | $124,174 | -$37,902 | ||||

| 7/1918-6/1919 | D | D | R | D | R | 77% | $27,391 | $162,077 | $62,810 | $$$$$$ | |

| 7/1917-6/1918 | D | D | D | 67% | $14,592 | $99,266 | $55,284 | $$$$$$ | |||

| 7/1916-6/1917 | D | D | D | 15% | $5,718 | $43,983 | $10,564 | $ | |||

| 7/1915-6/1916 | D | D | D | 7% | $3,609 | $33,418 | $3,140 | ||||

| 7/1914-6/1915 | D | D | D | 7% | $3,058 | $30,279 | $859 | ||||

| 7/1913-6/1914 | D | D | D | 7% | $2,912 | $29,419 | -$338 | ||||

| 7/1912-6/1913 | D | D | D | no data | $2,916 | $29,757 | $488

(estimated) |

||||

| 7/1911-6/1912 | D | D | D | no data | $2,868 | $29,269

(estimated) |

no data | ||||

| 7/1910-6/1911 | D | D | D | no data | $2,765 | no data | no data | ||||

Comments on Table 1:

The largest one-year deficit in history was in fiscal 2008-2009, in the trough of the recession and the peak of TARP and stimulus spending intended to end that recession. Deficits decreased rapidly for the next two years as TARP loans were repaid and temporary stimulus ended, and have alternately grown and shrunk since then.

The figures for 2012-2013 are complicated by the debt limit standoff. The national debt typically varies by ± $10 billion from one day to the next, but from June 1 to Sept 30, 2013, the day-to-day variation was more like ± $100 million, as the Treasury used “extraordinary measures” (i.e. shuffling money from account to account) to stay just below the limit and avoid default. On Oct. 17, 2013, after the debt-ceiling deal, the official debt figure jumped by $328 billion in one day, presumably “unwinding” these “extraordinary measures”, and then returned to its normal ± $10 billion/day variation. To get a rough idea of the “true” debt, I’m treating 2012-2013 as thirteen months long, ending on Oct. 31 rather than the usual Sept. 30, and 2013-2014 as eleven months long.

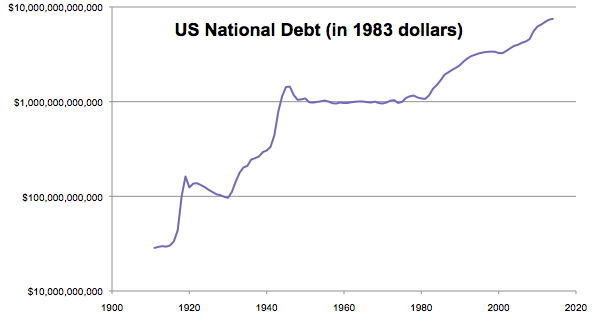

Graph: Real Debt, 1911-present

The following graph shows the “real” (inflation-adjusted) national debt over the past century. This measures “how difficult would it be to pay off the debt?” A “sustainable” budget is one in which it doesn’t get harder to pay off the debt — in other words, inflation-adjusted deficits and surpluses balance one another over a number of years. Sometimes (e.g. 1998-2001 and 1978-1981), the national debt grows in nominal dollars, but actually becomes easier to pay off because inflation has made those dollars “smaller”. I’ve put the graph on a log scale, so (for example) a 10% growth in 1941 looks the same as a 10% growth in 1915. (The vertical scale is labelled in 1983 dollars.)

Note the spikes for World Wars I and II, the smaller spike for the Great Depression, and the remarkable flat line from 1946 to 1981, during which time real national debt varied by less than 25%. In other words, the Federal government had a “sustainable” debt for 35 years, as years of surplus almost exactly balanced years of deficit. But since 1981, the real debt has grown by a factor of seven, shrinking in only three of those 33 years.

Table 2: The Top Ten Deficit Years

I have in my hand a copy of tonight’s Top Ten list….

2008-2009, at $933 billion

2009-2010, at $694 billion

2011-2012, at $424 billion

2012-2013, at $372 billion

1943-1944, at $361 billion

1942-1943, at $337 billion

2010-2011, at $310 billion

1944-1945, at $287 billion

2007-2008, at $262 billion

1985-1986, at $245 billion

Again, all of these numbers are in inflation-adjusted (1983) dollars.

Analyses by President

I then grouped the data by Presidential administration. As mentioned above, I consider the fiscal year spanning a Presidential election and inauguration to be part of the outgoing administration. This is usually a fair assumption, because most government programs take a while to start, and last for multiple years. Fiscal 2008-2009 is perhaps an exception: both the outgoing and incoming Presidents enacted expensive economic-stimulus programs that were written to take effect immediately. Accordingly, in the following tables, I’ve given George W. Bush two rows in the table: one for his whole term, consistent with all other Presidents, and one counting only his first seven years, ending with the figures of September 2008, by which time a recession had started but the government measures to deal with it hadn’t been enacted yet.

After deciding on those conventions, there were still several different reasonable ways to look at the data.

How much did the annual deficit shrink or grow?

I subtract the deficit in a President’s first year from the deficit in the year after that President stepped down (or, in the case of the current President, from the most recent deficit figures I have). This change in deficit is then divided by the number of years it took to achieve it.

Table 3: Average change in annual deficit

| President | political

party |

change in

deficit (millions) |

years in

office |

avg. change

in deficit |

avg. change in deficit ($ = 5billion) | |

|---|---|---|---|---|---|---|

| B.H.Obama | Democrat | -$771,282 | 5 | -$154,256 | $$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$ |

|

| G.W.Bush | Republican | $942,085 | 8 | $117,761 | $$$$$$$$$$$$$$$$$$$$$$$$ | |

| G.W.Bush | Republican | $271,139 | 7 | $38,734 | $$$$$$$$ | |

| W.J.Clinton | Democrat | -$173,244 | 8 | -$21,655 | $$$$ | |

| G.H.W.Bush | Republican | $50,010 | 4 | $12,503 | $$$ | |

| R.Reagan | Republican | $123,646 | 8 | $15,456 | $$$ | |

| J.Carter | Democrat | -$46,628 | 4 | -$11,657 | $$ | |

| G.Ford

(Note change of fiscal year) |

Republican | $103,701 | 3.25 | $31,908 | $$$$$$ | |

| R.M.Nixon | Republican | -$31,792 | 5 | -$6,358 | $ | |

| L.B.Johnson | Democrat | -$41,202 | 5 | -$8,240 | $$ | |

| J.F.Kennedy | Democrat | $3,617 | 3 | $1,206 | ||

| D.D.Eisenhower | Republican | -$12,680 | 8 | -$1,585 | ||

| H.S.Truman | Democrat | -$272,072 | 8 | -$34,009 | $$$$$ | |

| F.D.Roosevelt | Democrat | $252,936 | 12 | $21,078 | $$$$ | |

| H.Hoover | Republican | $38,120 | 4 | $9,530 | $$ | |

| C.Coolidge | Republican | $2,100 | 6 | $351 | ||

| W.G.Harding | Republican | -$18,097 | 2 | -$9,049 | $$ | |

| W.Wilson | Democrat | $11,573 | 8 | $1,447 | ||

Comments on Table 3:

The first seven years of the G.W. Bush presidency increased the real deficit by slightly more than the twelve years of the FDR administration.

If one includes fiscal year 2008-2009 as part of the G.W. Bush administration (consistent with my treatment of all other administrations), that administration oversaw 3.7 times as much increase in Federal budget deficits as the FDR administration.

Obviously, many of the reasons a deficit grows or shrinks are beyond the President’s control: Congress, the economy, the beginning or ending of a war, the beginning or ending of a recession, etc. For example, the beginning of World War II can be blamed for much of FDR’s increase in the deficit, just as the end of World War II and the start of the post-war economic boom can be credited for much of Truman’s matching decrease. I’m not sure what happened to Ford: he faced an economic recession, but so have many Presidents.

In my lifetime, every Democratic President has left office with a smaller deficit than he inherited, and every Republican President except Nixon has left office with a larger deficit than he inherited. This may be because Republican Presidents have placed high priority on cutting taxes, and placed lower priority on (or had less success at) cutting spending. Democratic Presidents have perhaps had equal success at cutting spending (I haven’t researched those numbers), but have not been bound by promises to cut taxes.

How much debt was accumulated over a President’s term(s)?

The previous approach, looking only at starting and ending deficits, doesn’t distinguish between a President who oversees initially increasing deficits, then decreasing at the end (like Reagan) and a President who oversees initially decreasing deficits, then increasing at the end (like Carter), even though the former racks up more of a debt. So I computed the average annual deficit over a President’s term(s).

Table 4: Average annual deficit

| President | political

party |

total

accumulated debt (millions) |

years

in office |

average

annual deficit (millions) |

avg. deficit ($ = 10billion) | |

|---|---|---|---|---|---|---|

| B.H.Obama | Democrat | $1,979,164

|

5 | $395,833 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$ |

|

| G.W.Bush | Republican | $2,257,471 | 8 | $282,184 | $$$$$$$$$$$$$$$$$$$$$$$$$$$$ | |

| G.W.Bush

first 7 years (see comment above) |

Republican | $1,324,910 | 7 | $189,273 | $$$$$$$$$$$$$$$$$$$ | |

| W.J.Clinton | Democrat | $216,821 | 8 | $27,103 | $$$ | |

| G.H.W.Bush | Republican | $754,365 | 4 | $188,591 | $$$$$$$$$$$$$$$$$$$ | |

| R.Reagan | Republican | $1,215,285 | 8 | $151,911 | $$$$$$$$$$$$$$$ | |

| J.Carter | Democrat | -$67,516 | 4 | -$16,879 | $$ | |

| G.Ford

(Note change in fiscal year) |

Republican | $168,666 | 3.25 | $51,897 | $$$$$ | |

| R.M.Nixon | Republican | $3,061 | 6 | $612 | ||

| L.B.Johnson | Democrat | -$39,077 | 5 | -$7,815 | $ | |

| J.F.Kennedy | Democrat | $35,824 | 3 | $11,941 | $ | |

| D.D.Eisenhower | Republican | -$23,101 | 8 | -$2,888 | ||

| H.S.Truman | Democrat | -$436,381 | 8 | -$54,548 | $$$$$ | |

| F.D.Roosevelt | Democrat | $1,251,713 | 12 | $104,309 | $$$$$$$$$$ | |

| H.Hoover | Republican | $78,458 | 4 | $19,614 | $$ | |

| C.Coolidge | Republican | -$32,457 | 6 | -$5,409 | $ | |

| W.G.Harding | Republican | -$4,767 | 2 | -$2,383 | ||

| W.Wilson | Democrat | $106,478 | 8 | $13,310 | $ | |

Comments on Table 4:

Again, Republican Presidents seem to rack up the big debts, at least in my lifetime (which started in 1964). Democratic Presidents (except Obama) tend to be “troughs” in the above graph, relative to their Republican successors and predecessors. Before 1964, the pattern is reversed: three of the four Democratic Presidents ran deficits over their time in office, while three of the four Republican Presidents ran surpluses.

The first five years of B.H. Obama accrued 7/8 as much total debt as the eight years of G.W. Bush, which in turn was almost twice as much as eight years of Reagan or twelve years of FDR. The biggest accrued-debt-per-year figures are associated with B.H. Obama, G.W. Bush, G.H.W. Bush, Ronald Reagan, FDR, Gerald Ford, Bill Clinton, and Herbert Hoover, in that order.

How does the accumulated debt compare with what it would have been with no change?

Since many of the items in the budget are multi-year commitments with considerable inertia (most obviously, interest on the national debt!), I recomputed the previous numbers, subtracting the annual deficit in each President’s first year. In other words, this table compares how much debt was actually accumulated with how much would have been accumulated if deficits had continued as they were when the President took office.

Table 5: Average deficit minus first-year deficit

| President | political

party |

average

deficit (from prev. table) |

deficit

in first year |

relative

average deficit |

relative avg. deficit ($ = 10billion) | |

|---|---|---|---|---|---|---|

| B.H.Obama | Democrat | $395,833 | $932,561 | -$536,728 | $$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$ |

|

| G.W.Bush | Republican | $282,184 | -$9,524 | $291,708 | $$$$$$$$$$$$$$$$$$$$

$$$$$$$$$ |

|

| G.W.Bush | Republican | $189,273 | -$9,524 | $198,797 | $$$$$$$$$$$$$$$$$$$$ | |

| W.J.Clinton | Democrat | $27,103 | $163,720 | -$136,617 | $$$$$$$$$$$$$$ | |

| G.H.W.Bush | Republican | $188,591 | $113,710 | $74,882 | $$$$$$$ | |

| R.Reagan | Republican | $151,911 | -$9,937 | $161,847 | $$$$$$$$$$$$$$$$ | |

| J.Carter | Democrat | -$16,879 | $36,691 | -$53,570 | $$$$$ | |

| G.Ford | Republican | $51,897 | -67,010 | $118,907 | $$$$$$$$$$$$ | |

| R.M.Nixon | Republican | $612 | -$35,218 | $35,830 | $$$$ | |

| L.B.Johnson | Democrat | -$7,815 | $5,984 | -$13,800 | $ | |

| J.F.Kennedy | Democrat | $11,941 | $2,367 | $9,574 | $ | |

| D.D.Eisenhower | Republican | -$2,888 | $15,047 | -$17,935 | $$ | |

| H.S.Truman | Democrat | -$54,548 | $287,119 | -$341,666 | $$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$ |

|

| F.D.Roosevelt | Democrat | $104,309 | $34,183 | $70,126 | $$$$$$$ | |

| H.Hoover | Republican | $9,614 | -$3,936 | $23,551 | $$ | |

| C.Coolidge | Republican | -$5,409 | -$6,036 | $627 | ||

| W.G.Harding | Republican | -$2,383 | $12,061 | -$14,444 | $ | |

| W.Wilson | Democrat | $13,310 | $488 | $12,822 | $ | |

Comments on Table 5:

Again, Truman is an outlier: he took office in the middle of World War II, which immediately followed the Great Depression. The Federal government was running an enormous annual deficit in his first year, so it would have been remarkable if it hadn’t decreased during his term. Likewise, Obama took office in the middle of, by far, the biggest-deficit year in history, dealing with two wars and the most severe recession since the 1930’s; it would have been remarkable if the deficit hadn’t decreased during his term.

In the past 100 years, there have been eight Democratic and nine Republican Presidents. Five of the eight Democrats oversaw average deficits smaller than they inherited, while seven of the nine Republicans oversaw average deficits larger than they inherited.

Leave a Reply